The expenses you may be able to deduct include the cost of travel and transportation, the expense of purchasing paper, envelopes and stamps for mailing resumes, and even the fee you pay to an outplacement agency that helps you find a job.Īnd if you find a new job that requires you to relocate-you may be eligible to deduct your moving expenses. Luckily, if you itemize deductions, you can deduct some of the expenses you incur when searching for a job. You may spend a significant amount of time each week looking through employment opportunities, going to interviews, mailing resumes and applying for jobs in person. There are, however, deductions available that cover the cost of looking for work and relocating for a new job (through tax year 2017). Some states don’t tax unemployment benefits, and in those cases, no state income taxes will be withheld.

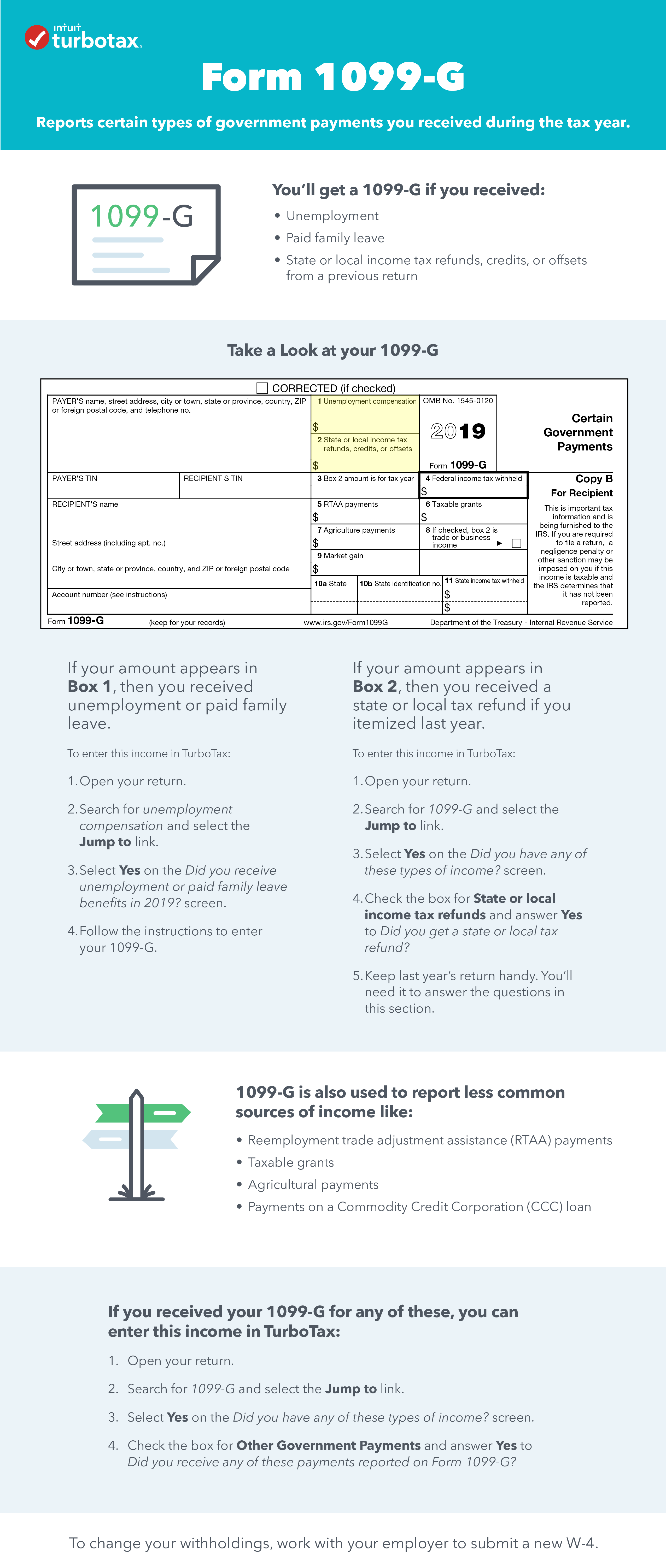

And if you elect to have federal and state income taxes withheld from your unemployment payments, the 1099-G will report those amounts as well. Your state will report the total amount to you on a Form 1099-G. If you receive unemployment compensation during the year, regardless of the amount, it’s fully taxable and you must report it on your federal tax return. But since you still need to file a tax return, you may be interested in some of the tax benefits available to you.

If you experience a period of unemployment or are currently unable to find work, the last thing you’re probably thinking about is your taxes. Hello, I’m Nick from TurboTax with some important information for unemployed taxpayers.

0 kommentar(er)

0 kommentar(er)